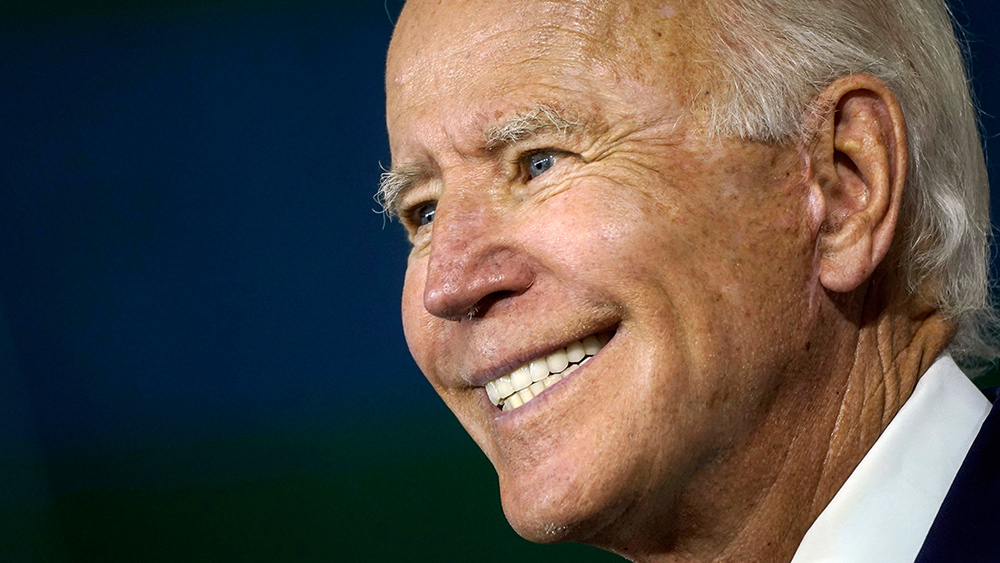

March 9, 2022 – the day Biden signed the death warrant on American freedom

11/01/2023 / By News Editors

Where were you on March 9, 2022, when President Biden signed the death warrant on American freedom?

(Article by James Rickards republished from DailyReckoning.com)

On that day, in a hushed ceremony at the White House without the approval of Congress, the states or the American people, Biden signed into law Executive Order 14067.

Buried in his order are a few paragraphs, titled Section 4. The language in Section 4 makes Order 14067 the most treacherous act by a sitting president in the history of our republic.

That’s because Section 4 sets the stage for legal government surveillance of all U.S. citizens, total control over your bank accounts and purchases and the ability to silence all dissenting voices for good.

In this new war on freedom, they aren’t coming for your guns. No, they’re thinking much bigger than that.

They’re coming for your money.

And it’s already started. These efforts are stepping up and taking on a nefarious tone that also involves surveillance and loss of our freedoms under the guise of central bank digital currencies (CBDCs), or Biden Bucks as I call them.

If you had asked me about this two years ago, I would have said the U.S. is taking a rather studious approach to it. It was too important to not be involved in, but the U.S. did not seem to be in any hurry to actually implement it.

There were studies, and I would have said my estimate at the time would have been, “OK, China has it. Europe, maybe another year. The U.S. might be three or four years down the road because the dollar’s too important. They don’t want to race into it. They want to get it right. There are a lot of ways to mess it up.”

But that’s changed under Joe Biden.

Biden has now fast-tracked this thing. We’ve moved pretty quickly from what I would call a research phase to an implementation phase. So I give it the name Biden Bucks, because Joe Biden will prove to have been responsible for actually implementing this at a very quick tempo in the United States.

NOT Cryptocurrencies

CBDCs are digital money, not cryptocurrencies. The differences between CBDCs and crypto are important.

Cryptocurrencies are recorded on a blockchain, which is a particular type of ledger that shows every transaction ever made in each currency.

Cryptos also claim to offer anonymity and decentralization, which are said to be virtues but are actually fatal flaws because the “anonymity” is a greater cover for crime and fraud.

I worked with the U.S. Strategic Command to unravel crypto ownership when Isis was using digital tokens to finance its caliphate in 2015–2016. It’s not easy to pierce the veil, but it can be done.

By contrast, CBDCs do not use blockchain; they have a digital ledger accounting system, but it’s not a blockchain. They’re the opposite of decentralized; they are highly centralized under the control of a single issuer, usually a central bank.

There’s no anonymity. The issuer knows every account holder and every transaction — that’s the whole idea.

CBDCs are promoted on the idea that transactions are faster, cheaper and more secure when all money is digital and controlled by a government.

Compared with credit cards, debit cards, wire transfers, Venmo and PayPal, that may be true. Those systems have multiple intermediaries and layers of fees, so CBDCs may actually be able to streamline payments and make the payment system more efficient.

But while the government positions CBDCs as a benefit to consumers in performing transactions, including faster settlements, better security, ease of use and transaction costs that are lower than with cash, it’s also crucial to think through the implications of the technology and how it could negatively affect the economy and our individual rights.

The Death of Privacy

The first part of the hidden agenda is to eliminate cash. If you’re the government and you want the central bank digital currency to succeed, you have to eliminate cash because it’s your competition.

Cash is anonymous. If you pay for something with cash, the purchase can’t be directly tied to you. That’s not true of Biden Bucks.

The government knows exactly what you’re buying, to whom you’re making donations and (by extension) what you’re reading based on which books you buy, etc.

That means we’ve come very far down the road toward thought control, censorship and selective law enforcement against political enemies.

It’s a government that looks like the state ruled by Big Brother in George Orwell’s Nineteen Eighty-Four.

The government might want to freeze your account, they might want to seize your assets, they might want to put an expiration date on your money.

Imagine you get paid and the government says, “OK, you got the money. Nice job, but that money is going to evaporate or disappear if you don’t spend it in the next six months.” How’s that for a stimulus program?

None of these things is possible if there’s cash around. But if you get rid of cash and force everyone into a digital system, then you can do these kinds of things.

That means fiscal policy can actually be dictated by Biden Bucks. With total control of your money, the government can conduct fiscal policy at will.

What if the government wanted to stimulate the economy and increase the amount of consumer spending? They could simply send you a letter that states, for example, “You must spend $200 in the next 30 days or we will take $100 out of your account as a penalty.”

As most citizens will not want to risk losing $100, they will spend the amount requested and create stimulus in the economy as the government had wanted.

This could also work in the opposite direction. Say the government wanted to cool down the economy and not have as much money in circulation. They could encourage savings by requesting a certain balance in your account be kept and not spent.

If you went under that set balance, a penalty would be triggered.

Private Banks Are Pushing CBDCs

All that being said, the digital takeover of the financial system is not an all-or-nothing event, and it will happen in stages and not all at once. When the CBDCs are finally rolled out, it may be a bit of an anticlimax if private companies have already eliminated cash and invaded privacy on their own.

For example, the Italian bank Intesa SanPaolo has begun forcing customers to use an all-digital mobile phone service with no ability for customers to visit a branch or interact with a human bank official.

This is exactly what the world of CBDCs will be like except that a private bank will be doing the dirty work and not waiting for a government mandate. The CBDC effort in Europe will inevitably involve the European Central Bank (ECB) since they are the issuer of the euro and will be in charge of the digital ledger of transactions.

Still, private banks are not waiting for the ECB and are laying the groundwork today for a world without cash or human bankers.

All that’s left is a digital ledger and total surveillance of everything you do.

Again, the endgame for CBDCs would closely resemble George Orwell’s dystopian Nineteen Eighty-Four. It would be a world of negative interest rates, forced tax collection, government confiscation, account freezes and constant surveillance.

You might not be able to fight back easily in the world of Biden Bucks, but it can be done.

There is one nondigital, nonhackable, nontraceable form of money you can still use.

It’s called gold (and silver). I urge you to get your hands on some while you still can.

Read more at: DailyReckoning.com

Submit a correction >>

Tagged Under:

biden bucks, big government, CBDCs, computing, conspiracy, cryptocult, currency crash, currency reset, digital currency, economic riot, Executive Order 14067, fascism, finance riot, freedom, Glitch, insanity, Joe Biden, Liberty, money supply, obey, Orwellian, privacy watch, surveillance, traitors, treason, Tyranny, White House

This article may contain statements that reflect the opinion of the author